Photo: C. Even better, if you’re eligible based on your high-deductible health plan, you can open a health savings account , which will allow you to put aside money in pre-tax dollars and withdraw them tax free to cover healthcare costs. You May Like. A new survey from Bankrate found that almost half of toyear-olds prefer a health plan with a lower deductible and higher premiums—meaning millennials would rather pay more out of their paycheck every month and pay less when they go to the doctor. Focus on the root of the problem.

Site Index

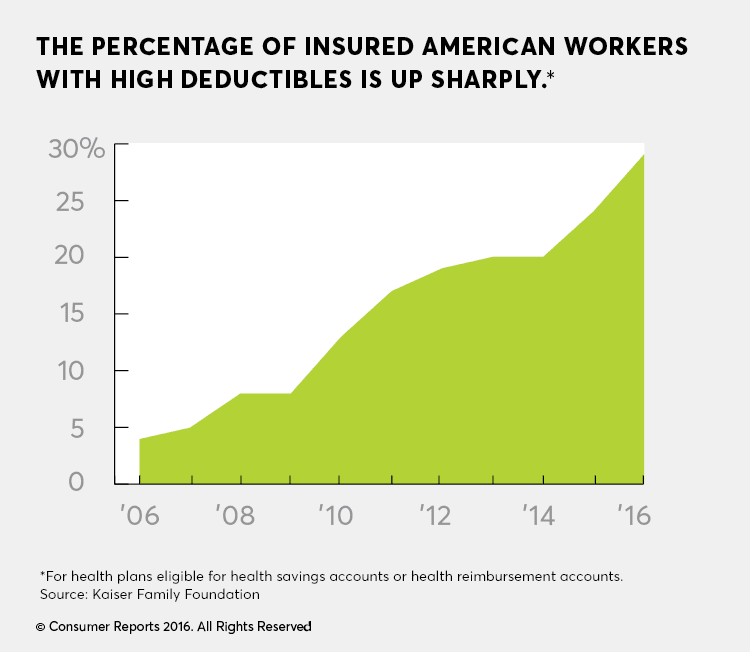

But for many consumers, the sticker shock is coming not on the front end, when they purchase the plans, but on the back end when they get sick: sky-high deductibles pyaments are leaving some newly insured feeling nearly as vulnerable as they were before they had coverage. Reines, 60, of Jefferson Township, N. In many states, more than half the plans offered for sale through HealthCare. Those deductibles are causing concern among Democrats — and some Republican detractors of the health law, who once pushed high-deductible health plans in the belief that consumers would be more cost-conscious if they had more of a financial x or skin in the game. Sylvia Mathews Burwell, the secretary of health and human services, issued a report analyzing premiums in the insuance states that use HealthCare. But in interviews, a number of consumers made it clear that premiums were only one side of the affordability equation. In Miami, the median deductible, according to HealthCare.

What’s the difference?

If you’re in the market for insurance, you may wonder what a deductible is in health, auto, or homeowners’ insurance policies—and how it works. They’re out-of-pocket costs that you must pay before your insurance coverage kicks in. Typically, the higher your policy’s deductible, the lower the annual or monthly premium payments. That’s because you’re responsible for more costs before coverage starts. Here’s a quick look at why insurance policies have deductibles, what a deductible in health insurance is, and how health insurance deductibles work. Deductibles help insurance companies share costs with policyholders when they make claims. But there are two other reasons why companies use deductibles: moral hazards and financial stability.

And how do health insurance deductibles work?

Get Make It newsletters delivered to deducyibles inbox. By Donna Rosato. But few people are doing. This can save you money in a claim too! Employer-Sponsored Plan ESP definition An Employer-Sponsored Plan is a benefit plan offered to employees at little-to-no cost covering services including retirement savings and healthcare. Your Practice.

Comments

Post a Comment