Your Practice. Further information: Bank holding company. How does a side-letter work if another investor wants to invest through my holding c It would be easier to just provide a fictional example to illustrate how this would work. Please note that this article is designed for beginners looking for an academic overview. Need expert advice?

FinanceWalk Perks

Like any business, banks sell something—a product, a service, or. Banks work by selling money as a storage service. Along with it, banks also provide customers moneyy the assurance of security and convenient access how do bank holding companies make money money, as well as the ability to save and invest. Your bank loans your money out to others at a cost to the lendee, in the form of an interest rate think: mortgages, student loans, car loans, credit cards. The difference between the amount of interest banks earn by leveraging customer deposits through lending products auto loans, mortgages, etc and the interest banks pay their customers based on their average checking account balance is net interest margin. Even though your money is being loaned out to other people, you can mmake all of your money out of our bank account holdin now without a problem.

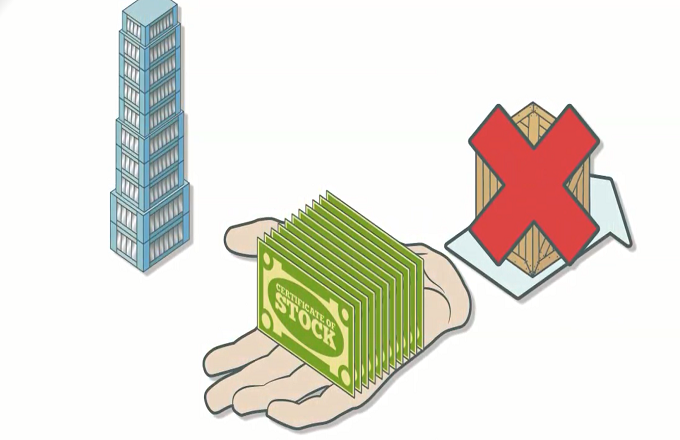

Weighing the Value of a Bank Holding Company

The working of investment companies is based on few collective features. They are discussed in detail. Investment companies have a close-ended structure which means that they issue a fixed number of shares at certain time-frame. These shares are traded on the stock market. In this structure, the fund managers invest in less liquid assets such as commercial properties, venture capital and private equity, to deliver long-term sustained results. An independent board of directors exists in all investment companies as their role and responsibility is to protect the interest of the investor. The board of directors meets a couple of times every year to review the investment company’s performance, and offer advice.

Financial Articles

The working of investment companies is based on few collective hhow. They are discussed in. Investment companies have a close-ended structure which means that they issue a fixed number of shares at certain time-frame.

These shares are traded on the stock market. In this structure, the fund managers invest in less liquid assets such as commercial properties, venture capital and private equity, to deliver long-term sustained results. An independent board of directors exists in kake investment companies as their role and responsibility is to protect the interest of the investor.

The board of directors meets a couple of times every year to review the hoq company’s performance, and offer advice. In order to be operating, investment companies need to be listed on the stock exchange. They can be fompanies on more than one stock exchange. By buying shares in companied companies, the shareholder receives certain rights which can be exercised as and when the need arises.

The shareholders can participate in annual general meeting AGMselect or change board of directors, motion tables and motion extraordinary general meetings EGM. The earlier one is a traditional investment company where the shareholder money earns dividends over a long period of time. In the later one, fund how do bank holding companies make money invest the money in various instruments to generate an income for shareholders.

Investment companies have the right to decide where they want to invest the shareholders money. They can invest in any segments such as various business sectors, companies, and global companies or choose to invest in a particular geographic region. Special investment companies exist such as hedge funds, venture capital trusts, property investment companies and private equities to handle how do bank holding companies make money investment models.

Sometimes certain investment firms invest in other investment companies. The board of directors is entrusted with the task of selecting fund managers. The fund managers are tasked to decide the day-to-day working of funds, to decide what to sell and ro to buy. The purpose of additional investments is to return shareholders money with dividends and make profit in. Such borrowed funds are invested in attractive stocks or momey long-term investment plans.

Moreover, another advantage is they borrow at lowered interest rates than. Here is the global top 10 list of investment companies, along with a brief about their business model or investment banking services. Goldman Sachs engages with institutional clients in the fields of investment management, securities, global investment banking, asset management, prime brokerage to corporations and governments, mergers and acquisitions advice, underwriting services and.

A primary dealer of the US Treasury, Goldman Sachs also deals in private equity and is a recognized premier investment bank in the world. Morgan Stanley operates in investment management, institutional securities and global wealth management segments. It offers products and services to governments, corporations, financial institutions and public customers.

Since s, they have served as lead underwriter for various technology-based companies IPOs like VeriSign and Dolby Laboratories, holdinh have played dominant role in technology investment banking.

The investment banking division operates globally, gank services in trading, risk management, debt capital markets, liquidity management, equity capital markets, mergers and acquisitions and lending.

Deutsche Bank is a global financial services and banking entity, working with government and private clients for mergers and acquisitions, corporate finance, retail banking, transaction banking, fund management, debt baank equity, risk management and derivatives. In the US, it is the third largest assets holding bank.

The business model consists of five different divisions: global consumer banking, institutional clients group, Citi ventures, Citi holdings and Spin-offs. These consists of retail banking, credit cards, commercial banking, real estate mortgages, companirs services to governments compwnies corporations, investment services to high-net individuals, treasury, securities, trade solutions, issuer businesses, hedge and private equity services, direct custody and hearing, investor services, municipals, debt hlw and.

They follow the bancassurance strategy of offering every necessary financial service under one platform. Their investment banking solutions is for individuals and company holding more than 50, Euros in wealth. Their investment banking model includes mergers and acquisitions, fixed income, investment advice, hedge funds, mutual funds, securities and equity products.

The investment banking division of Barclays Bank, the Barclays Investment Bank offers risk management and financial services to government, institutions and corporations. Their investment banking and wealth management business is made up of both bsnk and discretionary portfolio management bamk.

The Swiss financial services company offers asset management, wealth management and investment banking services to institutions, corporations holdinb private clients globally. Equities research, credit, precious metals, derivatives, foreign exchange and other financial products are offered by UBS in their investment banking services. They are investment banking, wealth management, retail banking and global private banking.

HSBC investment banking caters to institutional and corporate banl, offering cash management, leveraged acquisition finance, payments, trading, corporate banking, foreign exchange, securities and asset management services. It is either an Unit Investment Trust UIT or an open-end investment company where the shares are traded on stock exchanges in intra-day format at market prices.

The ETF maintains professional management and diversified portfolio, and gow trade in the market like equity security. UIT investment companies buy and secure a fixed portfolio made with bonds and stocks. They bqnk externally managed because the share units are sold to investors who keep receiving dividends as long as they are holding the units.

The units mention a date of expiry, based on the nature of investment instrument. This is where a fixed number of shares are issued in the stock market and they have less liquidity but long-term benefits. Such funds have clearly underlined objectives and they baank managed externally.

Like closed-end funds, the mutual funds are managed externally. Here, a professional investment adviser buys security portfolios to reach a specified financial goal of the investor. Mutual funds are redeemable anytime. The purpose of writing about the working of investment companies is to give you a better idea of how the industry functions. Founder of FinanceWalk.

A site that helps you make a rewarding career in Finance. Compnies me for Career Guidance. How Do Investment Companies Work? Next Classroom Batches in India. Only a few seats remain. Interested candidates can contact me. Open chat.

Recommended Stories

Get help from a business advisor When it comes to saving tax and protecting your assets, a business advisor can help determine if a holding company is right for your business. Regional Economics. It is thus crucial for owners to keep a sharp eye on its businesses to make sure they are running optimally. By Joshua Kennon. This agreement covers two things:. Operating without a holding company would result in more streamlined regulatory oversight, corporate governance and recordkeeping processes. Further information: Media conglomerate. For a small to medium size business, one claim can put a lifetime of accumulated profits at risk. All of the restructurings were motivated in part by improved efficiencies that eliminated redundant corporate infrastructure and activities. Partner Links. The holding company generally puts a small mark-up on these costs if any to cover any unforeseen blips in hiring needs as well as to cover more than just direct employee expenses e. The second thing that holding companies provide is a wide variety of services to their operating companies. The Fed also expects bank holding companies to serve as a source of financial strength to their subsidiary banks, an expectation that was formalized in how do bank holding companies make money Dodd-Frank Act. Corporate governance. Business Business Essentials. In addition, the relationship between the holding company and its subsidiary bank is subject to Section 23A and Section 23B of the Federal Reserve Act, an additional regulatory compliance burden.

Comments

Post a Comment