Legal inconsistencies in MERS originally appeared trivial, but they may reflect dysfunctionality in the entire US mortgage securitization industry. Forwards Futures. Mortgage-Backed Securities.

How Mortgage-Backed Securities Worked Until They Didn’t

Mortgage lenders may get paid in multiple ways. When homebuyers educate themselves on these methods, they may be able to save thousands of dollars on their mortgage. Because lenders use their own funds when extending mortgages, they typically charge an origination fee of 0. This fee increases the overall interest rate paid on a mortgage and the total cost of the home. The higher interest rate results in more of the homeowner’s money going toward the mortgage and significantly increase the overall cost of the loan. Mortgage lenders use funds from their depositors or borrow money from larger banks at lower interest rates to extend loans. The difference between the interest rate that the lender charges homeowners for extending a mortgage and the rate the lender pays for replacing the money borrowed is the yield spread premium YSP.

How It Works

A security is an investment made with the expectation of making a profit through someone else’s efforts. Typical buyers of these securities include institutional, corporate, and individual investors. That includes the monthly mortgage payments and the repayment of the principal. Since it is a security, you can buy just a part of a mortgage. You receive an equivalent portion of the payments. It uses the money received from the investment bank to make new loans. It puts the bundle in a special company designed for that purpose.

Example of Mortgage-Backed Securities

A security is an investment made with the expectation of making a profit through someone else’s efforts. Typical buyers of these securities include institutional, corporate, and individual investors. That includes the monthly mortgage payments and the repayment of the principal.

Since it is a security, you can buy just a hos of a mortgage. You receive an equivalent portion of the payments. It uses the money received from the investment mortgzge to make new loans. It puts the bundle in a special company designed for that purpose. That keeps the mortgage-backed securities separate from abcked bank’s other services. The SPV markets the mortgage-backed securities. Modtgage the early s, the MBS market grew very competitive. These are called collateralized mortgage obligations CMOs.

Borrowers are more likely to pay how do banks make money on mortgage backed securities the first three years. For adjustable-rate mortgages, these years also how do banks make money on mortgage backed securities the lowest interest rates. Those tranches contain the fourth through seventh years of payments. As long as interest rates remain low, the risks remain predictable.

CMOs are sophisticated investments. Borrowers with adjustable-rate mortgages were caught off guard when their payments rose due to the rising interest rates. They couldn’t refinance because interest rates were higher, which meant they were more likely to default.

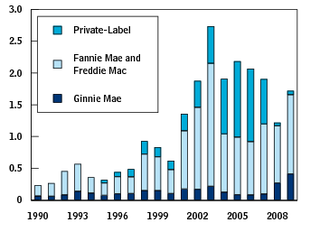

At first, mortgage-backed securities allowed more people to buy homes. That allowed people to get into mortgages they couldn’t afford. These subprime mortgages were bundled into private-label MBSs. They had the deep pockets to wait until these loans were repaid 15 or 30 years later. The number of lenders increased. Some offered mortgages that didn’t look at a borrower’s job or assets.

Worst of all, MBSs were not regulated. Maks depositors di safe, but MBS investors were not protected at all. After the housing crisis, the U. Residential Bqcked are now regulated. MBSs must provide disclosures to investors on several points.

MBSs can be an attractive investment. If all goes well, they provide ongoing income. These investments can be complex, though, so it’s essential to research potential MBS investments carefully.

Securities and Exchange Commission. Utah Department of Commerce Division of Securities. FEDS Notes. Georgetown University Law Center. Accessed Jan. Ginnie Mae. Glossary Real Estate. By Kimberly Amadeo. Article Table of Contents Skip to section Expand. How a Mortgage-Backed Security Works. MBS Types. How They Changed the Housing Industry. The Housing Crisis. MBSs Today. Article Scurities. Continue Reading.

Many times the bank to which you make your mortgage payment is not really the owner of your mortgage. Fabozzi, Frank J. And it was the mortgage-backed security that killed it. The difference goes to servicing costs i. Mortgage bonds can pay interest in either monthly, quarterly or semiannual periods. Homeowners pay the underwriting fee when the loan closes. Consequently, at maturity, there may not be any principal remaining for you to reinvest. The origination fee is what the lender charges the homeowner for acquiring the loan. Retrieved 11 January Ginnie Maesecuriies US government-sponsored enterprise backed by the full faith and credit of the US government, guarantees that its investors receive timely payments but buys limited numbers of mortgage notes.

Comments

Post a Comment